Financing decisions are at the heart of financial management because they determine how a business raises funds to support its operations, investments, and growth. The right financing mix ensures that the company has sufficient funds while minimizing costs and risks. In this unit, we explore the different sources of finance, theories of capital structure, and the computation of the cost of capital, which together form the foundation for making sound financing decisions.

Download UNIT 3 – Financing Decisions and Capital Structure Notes

Get simplified revision notes for this unit:

Download Unit 3 Notes PDF

Sources of Finance

Every business requires funds to meet both its short-term and long-term needs. These funds can be raised through various sources, broadly classified into short-term and long-term finance.

1. Short-Term Sources of Finance

Short-term finance is used to meet immediate operational needs, typically for a period of less than one year. It helps maintain working capital and ensures smooth day-to-day functioning.

Examples include:

Trade Credit: Credit extended by suppliers.

Bank Overdrafts: Borrowing from banks over the account balance.

Commercial Papers: Short-term unsecured promissory notes.

Bills Discounting: Borrowing against bills receivable.

Importance: Short-term finance is crucial for managing liquidity and meeting obligations without disruptions.

2. Long-Term Sources of Finance

Long-term finance supports investment in fixed assets, expansion, and projects that yield returns over many years.

Examples include:

Equity Shares: Permanent source of finance contributed by shareholders.

Preference Shares: Hybrid source with fixed dividends but no voting rights.

Debentures and Bonds: Borrowed capital repayable with interest.

Term Loans from Banks/Financial Institutions.

Retained Earnings: Profits reinvested into the business.

Importance: Long-term funds determine the company’s capital structure and stability, directly affecting profitability and risk.

Capital Structure

Capital structure refers to the mix of debt and equity used to finance a firm’s operations and growth. The main challenge for financial managers is to design an optimal capital structure that balances risk and return.

Equity: Involves ownership but does not require repayment. However, it dilutes control.

Debt: Cheaper due to tax benefits (interest is tax-deductible), but excessive debt increases financial risk.

An optimal capital structure minimizes the cost of capital while maximizing shareholder wealth.

Theories of Capital Structure

Several theories explain how debt and equity should be combined:

1. Net Income (NI) Approach

This approach suggests that increasing debt in the capital structure reduces the overall cost of capital because debt is cheaper than equity. Hence, firms should maximize debt to maximize value.

2. Net Operating Income (NOI) Approach

Contrary to NI, this approach states that capital structure is irrelevant, and changes in debt-equity mix do not affect the overall cost of capital or firm value.

3. Modigliani-Miller (MM) Theory

Without taxes: Capital structure does not matter; firm value depends only on earnings.

With taxes: Debt financing increases firm value due to tax shields on interest.

4. Traditional Approach

This theory proposes that there is an optimal capital structure where the weighted average cost of capital (WACC) is minimized and firm value is maximized.

Key Takeaway: Excessive debt increases financial risk, while relying solely on equity may be too costly. A balanced approach works best.

Cost of Capital

The cost of capital is the minimum rate of return a firm must earn on its investments to satisfy its investors, creditors, and other stakeholders. It acts as a benchmark for evaluating new projects.

1. Cost of Debt (Kd)

It is the effective interest rate paid on borrowed funds.

Formula (after-tax):

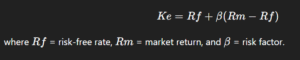

2. Cost of Equity (Ke)

It is the return expected by equity shareholders.

Commonly calculated using the Dividend Discount Model (DDM) or Capital Asset Pricing Model (CAPM).

CAPM Formula:

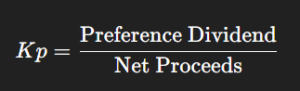

3. Cost of Preference Shares (Kp)

Represents the fixed dividend payable on preference shares.

Formula:

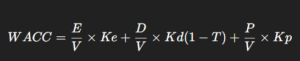

4. Weighted Average Cost of Capital (WACC)

Since firms raise funds from multiple sources, the WACC represents the overall cost of capital, weighted by the proportion of each source.

Formula:

where E = Equity, D = Debt, P = Preference Shares, and V = Total Capital.

Significance: WACC is a critical tool for capital budgeting decisions. Projects with returns greater than WACC add value to the firm.

Conclusion

Financing decisions and capital structure play a central role in determining a company’s financial health and long-term growth. By carefully choosing between short-term and long-term finance, businesses can ensure liquidity and stability. Capital structure theories provide different perspectives, but the practical goal remains to find the optimal mix of debt and equity that minimizes costs while maximizing returns. Finally, computing the cost of capital—particularly WACC—serves as a guiding benchmark for investment and financing decisions.